December is a month filled with festivities, celebrations, and the spirit of giving. However, it’s also a time when many people tend to overspend, leading to financial stress and post-holiday regret. To ensure a joyful and financially responsible holiday season, it’s important to have a plan in place to avoid overspending. Let’s discuss some practical tips to help you stay on track and manage your finances wisely during December.

Set a Realistic Budget:

Before the holiday season begins, take the time to create a realistic budget. Determine how much you can afford to spend on gifts, decorations, food, and other holiday-related expenses. Consider your income, savings, and any other financial obligations you may have.

Picture: Marissa Grootes/Unsplash

Make a List and Stick to It:

Create a list of the people you want to buy gifts for and the items you plan to purchase. Having a clear plan will prevent impulse buying and help you stay focused on what truly matters. Stick to your list and resist the temptation to make last-minute additions or extravagant purchases.

Research and Compare Prices:

Before making any purchases, do some research to find the best deals and compare prices. Take advantage of online shopping platforms, price comparison websites, and promotional offers.

Embrace DIY and Thoughtful Gifts:

Consider giving homemade or thoughtful gifts that don’t break the bank. DIY gifts, such as homemade baked goods, personalized crafts, or handwritten cards, can be more meaningful and cost-effective than store-bought items.

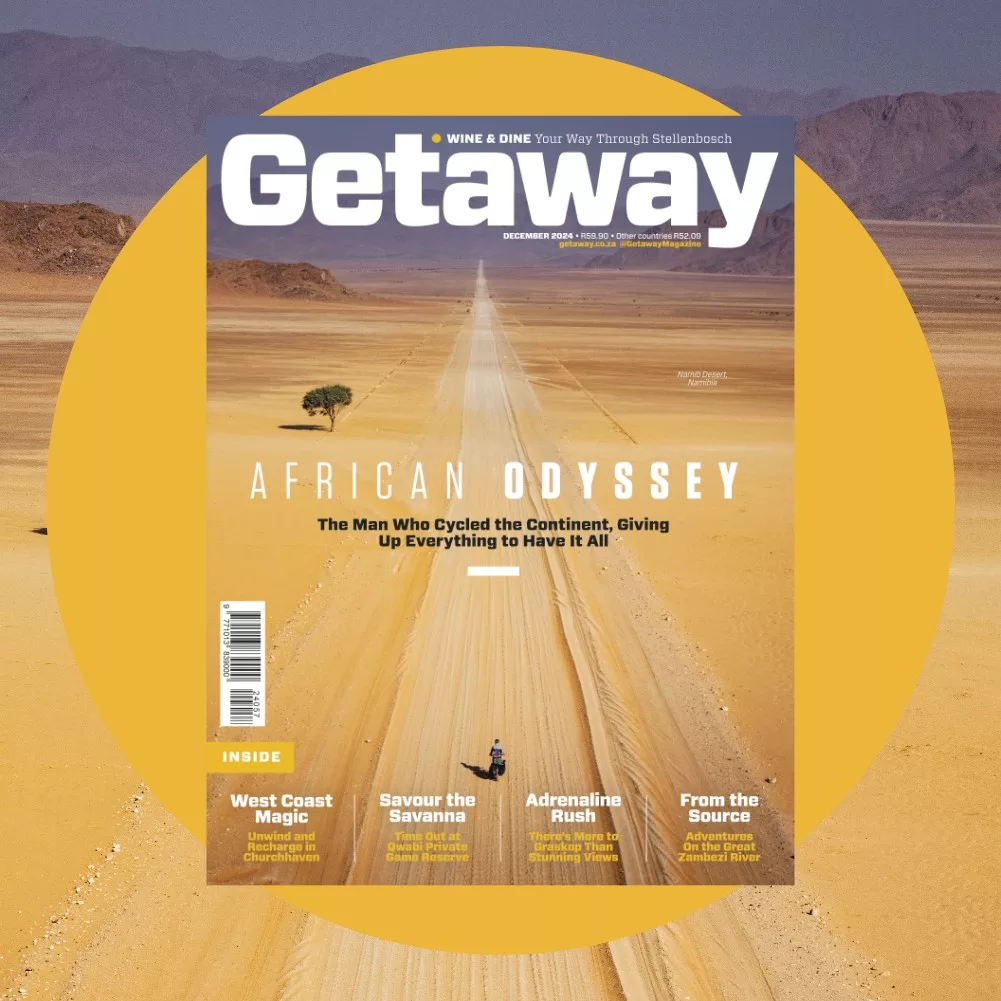

Picture: Olga safronova/Unsplash

Plan Ahead for Holiday Meals:

Food expenses can quickly add up during the holiday season. To avoid overspending on groceries, plan your holiday meals in advance. Make a detailed shopping list and stick to it while at the store. Look for sales and discounts, and consider buying non-perishable items in bulk.

Picture: S’well/Unsplash

Avoid Credit Card Debt:

While it may be tempting to rely on credit cards for holiday expenses, it’s important to avoid accumulating debt. Use cash or debit cards whenever possible to stay within your budget. If you do use credit cards, make sure to pay off the balance in full to avoid high interest charges.

Focus on Experiences and Quality Time:

Instead of solely focusing on material gifts, prioritize experiences and quality time with loved ones. Plan activities like game nights, movie marathons, or outings to local attractions. These experiences can be more meaningful and memorable than expensive presents. By shifting the focus away from material possessions, you can reduce the pressure to overspend.

Picture: Valiant Made/Unsplash

Follow us on social media for more travel news, inspiration, and guides. You can also tag us to be featured.

TikTok | Instagram | Facebook | Twitter